Buying a life insurance cover is always a tiresome affair especially when you as a buyer hardly know all the ins and outs of the life insurance product you’re planning to consider to protect your finances. Only one thing you know is, life is so uncertain and you don’t know what will happen in next few seconds. All you can do is plan for a better future rather than predicting the future. Life insurance policy is an easy way to secure your loved ones even after your demise in every unwarranted situation.

Wikipedia describes Life Insurance as:

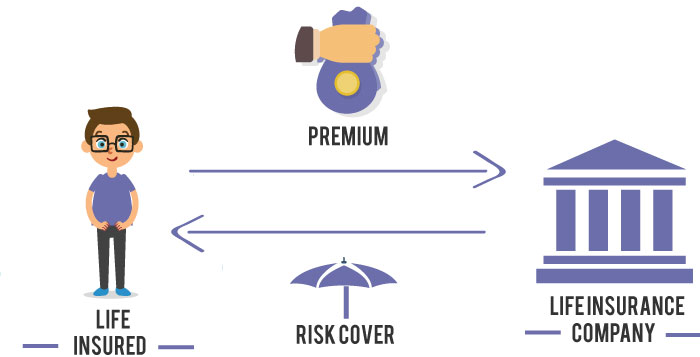

A contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefit) in exchange for a premium, upon the death of an insured person (often the policy holder).

Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policy holder typically pays a premium, either regularly or as one lump sum. Other expenses (such as funeral expenses) can also be included in the benefits.

Definitely, life assurance covers — whether they are term life, whole life or another variety — guarantee financial continuity by protecting ourselves against any eventuality. “Insurance has been a smart investment for years,” says David F. Keefe III, a financial adviser for 4-Point Financial in Waltham, Massachusetts.

Before you jump to any insurance product, consider the following tips on buying life insurance policy shared by the knowledgeable folks who deal with it every day:

1. Buy a policy at an early age

Because the chances of death are comparatively lower with young people than someone on the higher side of the age. Interestingly, for a 28-year-old man, an annual premium may range anywhere between Rs 8,500 to Rs 10,000 whereas an annual cost for a 40-year-old buyer range anywhere between Rs 15,000 and Rs 30,000. This is because of the simple reason that the risk of health issues and death is high as you grow old.

2. Know the purpose

It really makes sense to identify your requirements of buying an insurance policy. Suppose, if you want to provide financial cushion to your family, buying term insurance cover is beneficial because it offers pure insurance cover at lower premiums to dependents. On the other hand, if you are planning to enjoy at returns from your coverage, term return of premium (TROP) plans are the right choice as you’ll get the premium back from the insurer if you survived the coverage period.

3. Do your research work thoroughly

Buying a life insurance plan without proper research and analysis is foolishness. Go online to read up every possible information you’ve browsed about details of the insurer, type of plan, the duration of the cover, premiums etc. Don’t forget to refer the online insurance portals and compare the different plans available there.

4. Understand the document

Avoid buying an insurance plan that you don’t understand. You must get through all the terms and conditions of the policy. Ask your advisor or LIC agent to guide you through the process.

5. Cost of premium

It is something you’ve to pay to keep your life insurance policy active. You can choose to pay this monthly, quarterly or yearly, depending upon the policy and your choice. Make sure you agree to pay an amount that you can arrange every time because failure to pay the premium will result in policy lapse.

6. Keep all liabilities in mind

When purchasing a policy, you should take into consideration all the liabilities including age, income, the standard of living you maintain, the financial responsibilities you have, mortgage payments, other personal loans and of course, the future expenses that you may have every passing year.